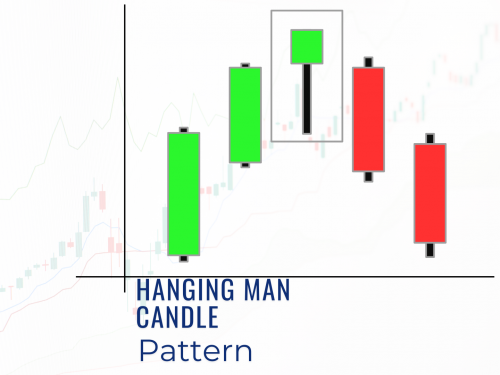

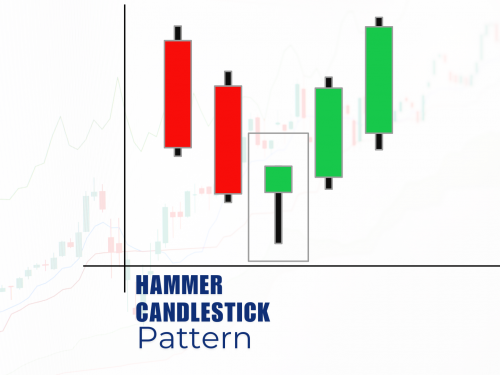

A hanging man candle's opening, closing, and high price are almost the same and look like a hammer candle. The hanging man candle has a small body candle with no upper shadow and the lower side has a lower shadow of at least twice of the the body candle.

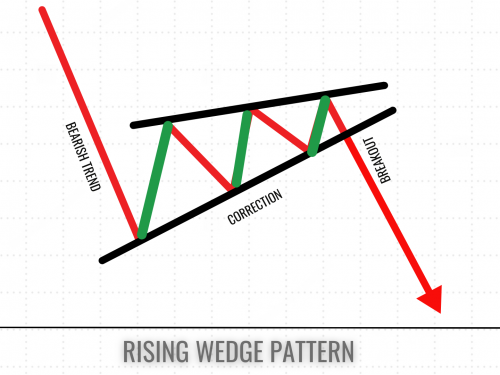

A rising wedge pattern is a chart formation that traders often spot in financial markets. It's like a triangle that's tilting upwards, with two converging trendlines. The upper line represents resistance, while the lower line shows support. As time goes on, these lines get closer together, creating a wedge shape.

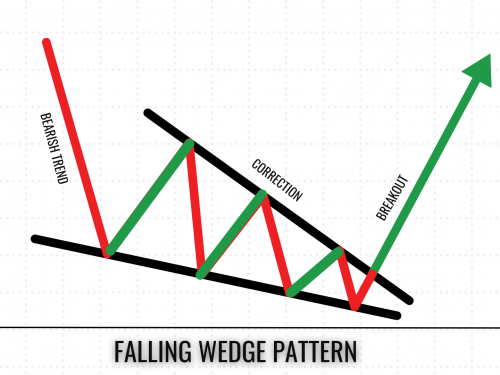

What is a Falling Wedge Pattern and How to Work with It?

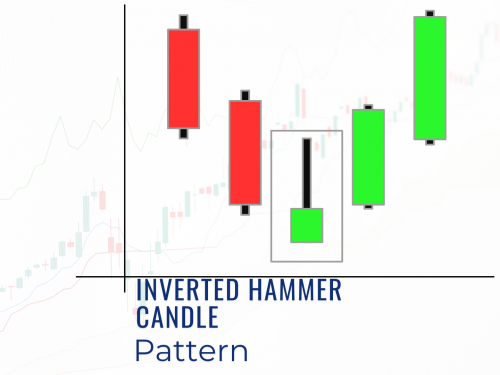

The inverted hammer candle looks like a shooting star and is opposite of the hammer candle. An inverted hammer candle has a long shadow candle upside and doesn’t have lower shadow.

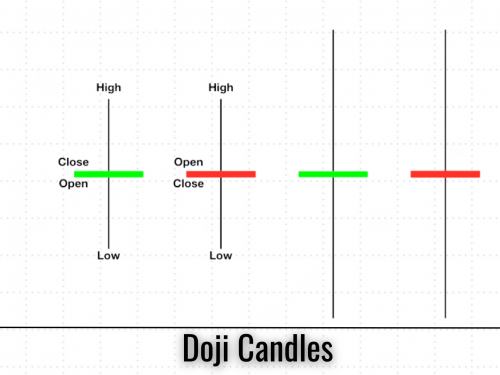

When the candle starts, the buyer wants to buy, the stock and the price move up, seller starts selling on the stocks due to this reason stock unable to move up, and the situation for the seller. When the seller wants to sell and the buyer starts buying and price is unable to move downside. In this way, the stock is trading at the same level and unable to move upside and downside. Finally, a candle

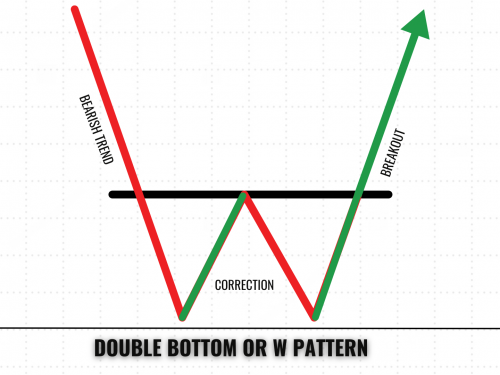

The double bottom or W pattern is a bullish reversal chart pattern, which looks somewhat like the English letter W. The double bottom pattern is most commonly used in intraday trading and swing trading. The accuracy of the W pattern is almost 70-75%.

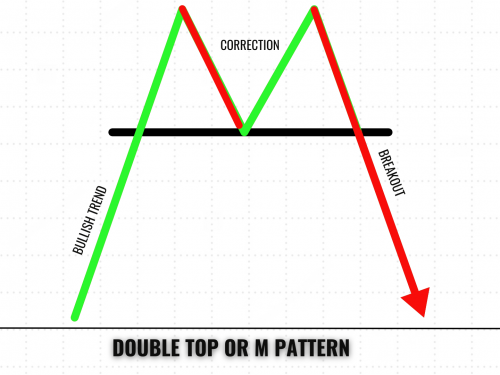

Double top or M pattern, which is a bearish reversal pattern. That looks like the English letter M. The double-top pattern is most commonly used in intraday trading. The accuracy of the M pattern is almost 70-75% for intraday trading. Where the stock or index is unable to move up once the M pattern is formed. Due to this decline is seen.

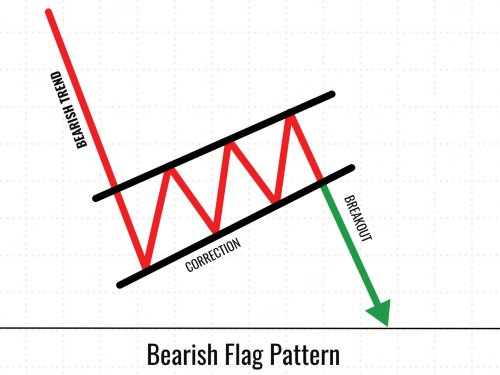

A bearish flag pattern is a chart pattern formed during a counter-trend down after a sharp fall in price movement. A bearish flag pattern forms during a downtrend. It got its name because it resembles a flag on a flagpole while the price continues to move in a downtrend, attaining lower lows and lower highs.

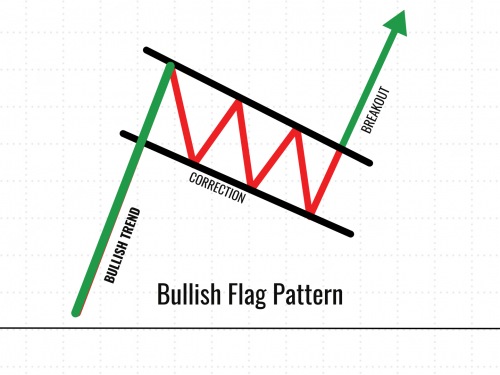

A bullish flag pattern is a pattern formed during a counter-trend move after a sharp price movement. Bullish flag patterns form during an uptrend. Imagine a flagpole (that's the initial price surge) followed by a rectangular shape (that's the flag part). This pattern usually means good things are coming for the price of whatever you're trading.

A resistance or supply zone is like an invisible ceiling in the stock market. It's a price level where a stock or index struggles to move higher due to which stock is unable to move upside from the level or when it reaches the resistance or supply zone, an investor selling their stock in the top-level called resistance or supply zone.

A support zone or demand zone is an area on a price chart where buying interest is strong enough to push prices higher. Supports are formed when a stock breaks above resistance and holds above that level: the old resistance then becomes support. Support levels are also formed when a stock spends a lot of time at one level and then breaks upward.

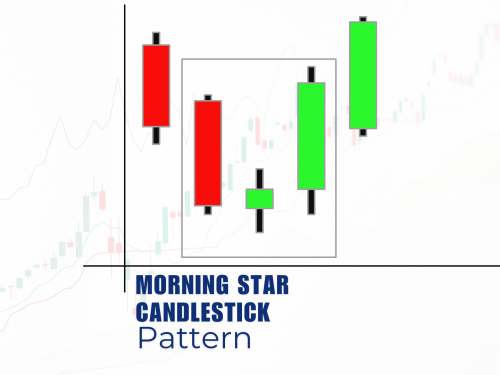

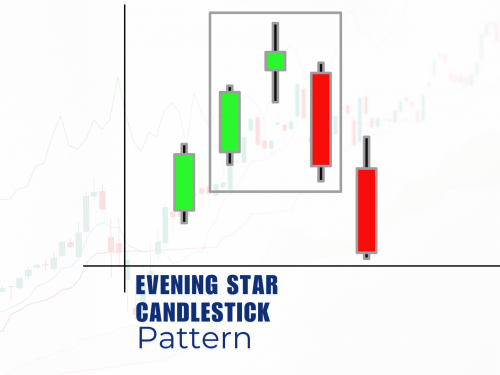

The morning Star candle is a bullish reversal candlestick pattern, which is a combination of 3 candles 1st is a Red candle 2nd is a Doji or star candle red or green, and 3rd candle should be a green candle. When the market is in an uptrend, the evening Star candle is formed at the upper level near the resistance zone or supply zone, and from there signals a bearish reversal.